Capital preservation, upside optionality - October 2023

Dear partners,

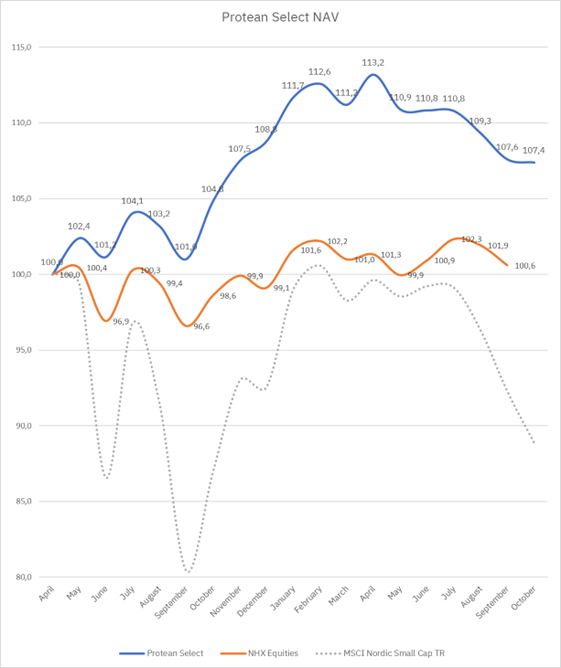

Protean Select returned -0.2% in October. The year-to-date return is -1.3%. Since our start, 18 months ago, the fund has returned 7.4%.

Protean Small Cap returned -5% in October. After five months, the fund is 0.5%-points after its Carnegie Nordic Small Cap-benchmark. Thank you for being an investor.

*We illustrate our performance by showing a comparison with the NHX Equities index. This is an index constructed from the performance of 54 Nordic hedge funds focusing on equity strategies. NHX is published after our Partner Letter, so updates with one-month lag in the chart above. We aim to have positive returns regardless of the market, but no return is created in a vacuum, and a net-long strategy will correlate. Our hurdle rate is >8% annualized (4% + 90-day Swedish T-bills). All performance figures are net of fees.

TLDR

· Protean Select returned -0.2% for the month, -1.2% YTD and +7.4% since inception.

· Our short position in the OMX index plus a basket of Swedish small caps, the long position in TELIA, and long position in Alleima (again!) were top contributors.

· On the negative side were long positions in Truecaller, Cint and Modulight.

· Protean Small Cap returned -5% in its fifth month.

· The benchmark Carnegie Nordic Small Cap Index was down 3.6% in October.

· Alleima, Ambea and Nolato were top contributors.

· CINT and Truecaller were the biggest detractors.

· After five months in existence, the fund is trailing its benchmark by 0.5%-points.

· The combined assets in our two strategies is approximately 850m SEK.

· Our net exposure to equities in Protean Select is currently 28%, our gross exposure 100%.

· The portfolio remains diversified. No long position is bigger than 4.5%, and no single short position is bigger than 2%.

This month’s letter elaborates on a few of the short positions we have in the fund. Why Axfood is a reasonable risk/reward short, why we now are net negatively exposed to banks, why DSVs venture into an asset heavy Saudi project is similar to when Michael Jordan decided he could be a great baseball player too, and why Private Equity is past its prime.

What happened in October

After adjusting to a more cautious stance during September we thankfully had a rather uneventful month in the Select fund. For the vast majority of the month we were tracking to return north of 1%, but our best laid plans were capsized by a handful of outsized single stock reactions to results. More on that below. We remain cautiously positioned, aiming to protect the downside, but insist on running a net positive exposure and an overweight small caps. Perhaps silly during this pervasive bearishness, but who knows when things bottom out? If you have a definite answer, we’re all ears.

Here’s the deal: the Select fund has the objective to create returns regardless of market climate. It is also net long the market and has an overweight small cap stocks by default. These objectives are an inherent conflict. Particularly in a market like this, where all stocks are going down, small caps in particular. Not an excuse, just a reflection that with our structure it’s a tad… umm… “challenging” right now. We are somewhat pleased to have protected capital reasonably in October, but annoyed that the bulk of the negative contribution is from a very limited number of stocks that saw outsized reactions to their Q3 reports. Could we have worked harder to avoid this? Not sure.

Several of the reactions this month are in cases where we think the upside is 3-500% over a few years and where we have a multi-year holding period (until something changes fundamentally) – frankly, who cares if we were a couple of months too early and lived through a 20% draw-down in a single name. We’d rather not, of course, but it’s the price we pay for conviction.

We take comfort in being patient and that, despite a boring few months for us, we are well ahead of any index since inception of the fund, and “only” marginally down on the year. We would have loved to print better performance every single month, but this is a long-term game, and we will keep making mistakes. It’s simply part of the process: regardless of how asymmetric the risk you take, it still means you take actual risk, and every now and then said risks will materialise on the wrong side of the asymmetry (i.e. we’re plain wrong). The key, if you ask us, is to limit the damage from mistakes, which we believe we have done.

We measure ourselves on a three-year horizon and do not manage for monthly returns. This means we accept a reasonable bit of volatility in the fund. As we have repeatedly warned we will have periods of negative performance: we are right now in such a period, even if we are outperforming the indices, it’s still not where we want to be.

We are pleased to have protected capital despite the stubborn net long exposure, and overweight small caps. But displeased with the absolute performance. There’s no sugar coating that.

Enough about the fund and performance, it’s incredibly boring to justify lukewarm lack of short term returns, let’s talk about stocks and markets instead.

Protean Select – update for October

The Select fund returned -0.2% for October, and is now down 1.3% for the year. Several stocks went our way this month, and we think a fair few of our long positions are in early phases of either turning around or at least providing ample alpha potential. But – that goes for every portfolio (and portfolio manager!) out there.

What’s far more interesting is to look at the stocks that did particularly poorly in the past month. So, here’s two of our more prominent idiot sandwiches for the month:

CINT - A tale of two segments

This was a top-3 worst performer in October. It single-handedly cost us about 0.5% of the fund’s value when it crashed and burned almost -40% on reporting day. Yikes! Our investment thesis in CINT, however, hinges on the Media Measurement-business. This business tracks real-time ad effectiveness. It grew 49% organically in Q3 and is now 20% of CINT's sales. It has metrics which suggest that, if it was a stand-alone business, it would be worth more than CINT's current EV all by itself. So far so good. The problem is the other 80% of CINT's business which suffers from a combination of cyclical weakness and internal issues. In a myopic market with little forgiveness for weakness, the share got penalized for not being able to produce any cash flow in the quarter. Fair enough, but today’s valuation leaves ample upside, and after several meetings and number crunching, we are giving the new CEO the benefit of the doubt on his 2024-story, where there are internal measures and synergy levers aplenty to put CINT back at a growth- and cash generative-trajectory.

Truecaller - A framing issue

This, too, cost us 0.5%-points of the fund in October. Egg on our face, but, to us, Truecaller is a sustainable >10% volume growth company that has suffered from a weak ads markets leading to tangible price headwinds. In Q2, said price headwind was not evident as the IPL supported ad prices in the quarter. With poor visibility and, frankly, poor guidance, Mr Market was disappointed to see that the Indian ad market in Q3 was back at just a notch above Q1 levels. However, the reaction (-32%) is excessive if one believes this is cyclical and not structural. At current share price, assuming CPM rates are flat Q/Q for five consecutive quarters (mind you, Q3 is a seasonally weak quarter for ads), we conservatively expect Truecaller to grow ads revenues by 12% in 2024E. Meanwhile, non-ad revenues (20% of total) continue to develop favourably, driven by the very attractive Truecaller for Business-segment. Adding decent cost control and a healthy cash conversion, we think they could buy back 20% of the outstanding shares and still end up at >1x EBITDA in net cash by end-2025.

We’re also counting down to when it becomes consensus to search for exposure to India: literally the only global market of any size to enjoy relative political stability, economic growth and a benign demographic situation.

These two positions by themselves cost us about 1%. Argh. The flip side of this was 0.4%-points from Telia (which, at time of writing, is back right where it traded before the blow-out numbers), that we closed out +10% on reporting day, plus nice contribution from a handful of fundamental short positions in Electrolux, Nokia, Husqvarna, Evolution, Netcompany, Chemometec, Swedbank, Atea, EQT, Kinnevik, and Thule etc etc. Had we had a more cowboy mentality and sized our shorts more aggressively, our results would be different. We are aiming to be more aggressive on the short side when we have conviction, but it’s a different value proposition, with different return characteristics, why we remain somewhat reluctant to oversize shorts.

In summary, it was a balanced month. At the time markets bottomed at -5-7% mid-month, we were up 1.3% and felt on top of the world. Cue humble pie in the form of Cint and Truecaller, and a bounce in a handful of short positions – and the month ended at a mediocre -0.2%.

We continue to run a net positive exposure, and an overweight small and mid-cap stocks. Over time we believe this mix is what makes money. We protect the downside but try and keep the optionality of upside intact.

Protean Small Cap – Carl’s update for October

October was a difficult month. The benefit of starting a small cap fund in a down market is that you can gain entry to value-creating companies on the cheap. The flipside is that they can become a lot cheaper once you have bought them. Protean Small Cap returned -1.6% in relative terms during October, and

-5.0% in absolute terms. That puts us roughly on par with index since start and given our preferential position in terms of size of the fund (being smaller creates better opportunities) and the level of commitment we’re not happy with this, but it’s a marathon – not a sprint.

We benefited from our positions in Alleima and Ambea. While very different in terms of what they do, they share a couple of equal characteristics as shares: they have a combination of relatively low valuation, strong near-term earnings momentum, and the opportunity to perform capital distribution and/or bolt-on M&A in the coming years to bridge any weaknesses stemming from the broader economy. They also have very straight-forward business models. We’ve upped our stake in the Swedish auto parts provider MEKO as it has similar traits.

The more myopic we have been in our investment thesis, the better the outcome has been so far. The larger the market cap of the company, equally so. The lack of liquidity for many small caps have created brutal effects as many funds with outflows are culling losers in an extremely unsentimental way.

We’re hit by cyclical weakness being interpreted as structural problems in a few names. It’s easy to say that the reactions were excessive, and that the risk/reward has improved in these names, but that doesn’t alleviate the pain of the price declines. We have a few names in the portfolio, where the investment thesis hinges on a stepwise improvement of the actual operations. CINT was our biggest contractor in the month. Truecaller the second largest. The investor base in these two stocks is fickle, so they do have a trait of binary outcomes when they report. We were more surprised by the reaction to the Coor results, which collapsed after slightly worse than expected earnings level, but also some comments about a wish (NB: not a “need”) to reduce the debt level in the company, in the wake of higher interest rates. We added to our stake in Coor after the report. It trades around the IPO price of 2015, despite being more diversified in terms of customer base, higher earnings level (+>50%) and a track record of earnings stability.

We’ve also added a few new positions, let’s elaborate on two:

SOBI, a Swedish biopharmaceutical, has become a sizeable position as we believe that the market is not fully grasping the potential of the RSV prevention drug Beyfortus. This was underscored by the strong Q3 report. SOBI is entitled to a perpetual royalty stream for the North American sales of the drug and whilst Sanofi is the owner of Beyfortus, SOBI is the best pure play on it (given the size of the parties involved). The company has an M&A track record that appears underrated, and we note that there was a failed bid for the company at SEK 235 two years ago. This is in line with where the share price is trading today and the opportunities for SOBI has improved since.

We participated in the IPO of Rusta. This Swedish variety hard discount retailers had an unusually compelling set-up for its offering with reasonable valuation, net cash, and with a growth runaway which in our view stretches both in its legacy Swedish business, as well as other Nordic countries with a German option further out. The sellers could have easily added a chunk of debt in the company prior to the offering but didn’t, and even more unusual, they have been buying shares post the offering at a higher price than what it was sold at. It’s easy to be cynical about IPOs, but we see good long-term opportunities for Rusta, and there’s only one way to become a publicly traded company.

Axfood – Anatomy of a reasonable short case

Even a well-run company can make a fine short case. Axfood has been a big winner on Swedish food inflation in recent years, helped particularly by down-trading to their discount brand Willy’s. Following several quarters with improving earnings and growth rates, paired with the overall equity market contracting, we now find Axfood trading at a record premium to the market, at the same time as food inflation is rolling over.

This means there is no structural help for the business ahead, and limited valuation upside. The risk/reward being short Axfood here looks favourable. Throw into the mix that competitor Lidl is making slow and steady progress in Sweden, helped in part by clever and fast-footed marketing campaigns, but also by the fact that they now are approaching an inflection point with close to 100 stores – reaching scale means independent brand owners have a hard time ignoring them, leading to an assortment that more and more resembles that of key competitors Axfood, ICA and Coop.

ICA has after a period or turbulence and lost market shares started to make noise on price campaigns again, and chances are they can regain their market leadership and share over the coming years. At the expense of Axfood.

There are few arguments as to why one should own the stock other than for its relative stability. A 3% dividend yield and zero earnings growth should probably not trade north of 20x PE. Perhaps it should trade on a 5-6% dividend yield and a 10-12x PE? That would mean a near 50% drop in the equity value. We don’t necessarily think that’s the base case, but it wouldn’t be outrageous. Hence the positive risk/reward: very hard to see it do well, relatively easy to see it do poorly.

Axfood is also a good pair with our Rusta position on the long side. In contrast to Axfood, Rusta has both a significantly lower valuation and substantial growth potential in its core markets. They also have a management team with skin in the game that is head and shoulders above Axfood in terms of quality.

Axfood is a top 3 short position in Protean Select.

DSV – It takes a lifetime to build a reputation, a minute to ruin it

This Danish freight forwarder has followed me my entire career. I still remember hearing the pitch the first time in ABG’s London offices on Paternoster Square back in 2006: “It’s an asset light roll-up of freight forwarding companies. Improving the density of a network reaps substantial synergies – just imagine the advantage of being able to drive with cargo both ways instead of going home empty when you have delivered a load somewhere.” This is exactly what DSV have done for the better part of 20 years, whilst handing back all excess cash to shareholders in the form of buybacks (and rewarding management handsomely via option programs).

For the past 16 years CEO Jens Björn Andersen has been at the helm. A straight-shooting no-BS Dane, that, despite his sometimes-rough edges, has won over investors and analysts by sheer financial performance and skill at integrating acquired units with minimal disruption.

When the first press release hit the tape that the CEO was “being replaced” we instinctively shorted the stock. Shoot first, ask questions later. Why was he being let go? Was the board not happy with performance? Did it mean the potential big acquisition of DB Schenker was off the cards (a potential negative as the markets like when DSV does deals, considering the long and illustrious track-record)? Was there something else? Not for a second did we think there was a disagreement on strategy between the CEO and the Board of Directors, considering how clear, time-tested, and proven DSV’s strategy has been for the better part of two decades. The strategy has always been crystal clear. How could there possibly be disagreement?

Little did we know DSV was about to make a U-turn and ditch the “asset light” part of the strategy, and instead partner with the (ESG-questionable) Saudi government to build a brand-new terminal and logistics hub in the middle of the desert. 20% of annual free cash flow for five years out the window on the NEOM-project (google it, it’s one of the most impressive hare-brained schemes I’ve seen – or how about, as but one example, a 500m tall, 200m wide and 110km long “city” in a straight line through previously uninhabited DESERT?).

Although management put on a brave face and argued the project follows the internal 20% ROCE target, when pushed they admitted “if we hadn’t done it, one of our competitors would have”. Competitor K+N the day after added insult to injury when asked if they had considered bidding for the project, but replied “it’s not asset light, hence not our business model”. Shots fired!

Like a clever friend put it: “Is this like the time Michael Jordan announced he would switch to baseball? Bulls fans would have preferred if MJ stuck to basketball, and DSV shareholders would have preferred if DSV announced the acquisition of yet another freight forwarder.”

Suddenly, without the crystal-clear equity story, focus is turning to the 32bn DKK net debt, the looming recessions, and all that other nonsense regular companies must put up with. DSV is close to being uninvestable for now. When the Q3 report came out, the news of the Saudi JV was lumped together with the usual quarterly figures (that looked ok-ish). Our take was that the market would not have digested the possible downside risks at the time of market open, why we doubled our short immediately. Suddenly, what had been a ‘lazy long’ for a lot of funds turned into something controversial and unpredictable. In a market such as the present, that’s not a good thing.

Two days and -10% later we covered the position. The stock has bounced 7-8% since, we’re eager to get involved on the short side again soon…

Banks – It was the best of times; it was the worst of times

Cheap, with profit momentum, high dividends and significantly improved ROE. What’s not to like?

First of all, we take the under on the bet the world has changed. In an economic slow-down, banks will eventually feel the pain of lending volumes falling, mortgage book and deposit base shrinking and, last but not least – the big bogey man – credit losses increasing. We are already seeing record bankruptcies in Sweden.

Second, banks are inherently susceptible to all sort of economic shocks. Most often these have throughout history taken the form of excessive lending to particularly the commercial real estate sector. In this latest iteration, over the past 10 years in Scandinavia, however, the riskiest lending seems to have been provided by bond investors rather than bank balance sheets, why we might see bond holders squealing first, before the banks begin to moan.

The banking sector is also heavily politicised. It should be, considering how crucial the credit flow and payment infrastructure is to modern economies, and how profits tend to be private, but losses public. Local regulators take different shots at the banks in every cycle, this is for example why Nordea recently moved its domicile from Sweden to Euro-member state Finland – to fall under the regulation of the European Union rather than the more unpredictable and politicised Swedish FSA. Rest assured the left leaning press in Sweden is up in arms about “immoral super-profits” and are calling for an aggressive windfall tax.

The low multiples we’re ascribing to current (super?) profits could be a result of the market thinking today’s net interest income levels are temporary. We would tend to agree. After having been neutral to slightly long banks for a few months, we are now net negatively positioned.

Private equity – Schrodinger’s Portfolio

Criticising private equity might be kicking in a wide-open door these days, but there is something inherently stupid about these billionaire factories. How can it be that investors are willing to pony up eye-watering fees for the doubtful benefit of being locked-in for a volatility laundering exercise that generates returns that are eerily like those of the public market over time?

The crux of the question is this: since fees are based on assets under management, there is every incentive to mark up valuations, but also to not mark down. Since the listed entities in private equity space are the management companies, there is little (nada, nil, zilch) disclosure on fund-level performance or metrics. We simply don’t know how companies are valued in the portfolio, what leverage is being employed, which companies have negative cash flow, which ones had an equity injection, what the cost of debt or cost of capital or peer group is being used when marking the assets to model (rather than market). To get a hint of portfolio level data you would need access to a closely guarded “data room” (a fancy word for webpage with some numbers), and this access is naturally only offered to significant fund investors, not equity investors.

There are a few listed investment companies with unlisted holdings. Let’s just say they trade at a decent discount to their reported values (they certainly do!). (Looking at you Kinnevik, a - 50% discount to reported unlisted values kind of tells the story of the distance between public market perception of values, and private DCFs… )

Bottom line, if you’re levered long small and mid-caps, and that space has cratered with an emphasis in the past few quarters, odds are your unlisted portfolio is a dumpster fire too. Particularly if you have populated said levered portfolio in the past few years when competition for private assets pulled valuation to never-seen-before highs.

Yet, investors in “alternative assets” (such as Private Equity) are still happily reporting that their investments in said funds have “held up well relative to public market investments”. Gees, you don’t say, wonder why that is? GLHF trying to sell that basket of levered beta at arm’s length to the values you currently mark them to in that make-believe portfolio of yours.

Don’t get me wrong, I’m the first one to applaud the financial ingenuity of private equity – monetising the behavioural flaw of short-termism via mandatory lock-ups and limited mark-to-market, adding carry and fixed fees is a genius play. Hat’s off. The problem, as always, is that of a Greek tragedy: the strength of the model becomes its weakness. Even if you have 7-year duration of a private equity fund, those seven years eventually come to an end. When leverage becomes more expensive by the day, and public market valuations continue to contract – how can one be expected to liquidate the successful PE fund that started 6-7 years ago? Public markets are not an option currently, and given the secondary market performance of a handful of notable PE-sold IPOs in Scandinavia in the past few years, the bar certainly has been raised. It is notable that the only IPO in October was a discount retailer, with no debt or primary component.

Cue some innovative suggestions from the industry: the EQT CEO was in the FT suggesting that a “private market auction” of certain assets could be one way to solve this Gordian know? Make no mistake, the “problem” is that public market valuations are “too low”, and doesn’t rhyme with where the marks in the portfolio are… The other alternative has otherwise been to solve via “continuation funds”, more recent raised vintage funds taking over old holdings, or by flipping to other deal-hungry private equity funds with freshly raised capital ready to be deployed.

In recent months several PE players have reported a slow-down in asset raising. This could be a canary in the coal mine. Industry statistics suggest the typical PE investors (pension funds, endowments, insurance companies) have peaked out their allocation to “alternatives” and that many are looking to reduce their exposure over the coming years. Adding this secular headwind to the steady beat of higher interest rates and lower public market valuations.

With insiders selling stock hand over fist, and return prospects dimming ahead, we think the private equity industry is due a wake-up call. The marks in the funds are make-believe, and similar to Schrodingers cat, you can’t know if it’s dead or alive if you don’t look.

The monthly reminder

We optimize for performance, not for convenience, size, or marketing.

You can withdraw money only quarterly (monthly in Small Cap).

We will tell you very little about our holdings.

Our strategy is tricky to describe as we aim to be versatile.

A hedge fund can lose money even if markets are up.

We charge a performance fee if we do well.

You do not get a discount if you have a larger sum to invest.

We do not have a long track record.

Pontus Dackmo

CEO & Investment Manager

Protean Funds Scandinavia AB