The Weltschmerz Cycle – March 2022

Dear Partners,

It’s getting close. We anticipate approval of the fund prospectus (Fondbestämmelser) literally any day now. Which will trigger a host of administrative footwork to set up the fund for launch. I won’t bore you with the details but let’s just mention that getting a tax number takes a “few days”, which you need to then get an ISIN-code (a common ID for all financial products) which takes ”a week at best”, which you in turn need to then get plugged in to distribution platforms which takes ”a few days”, which in turn you need to be able to receive deposits into the fund. They’re all very linked and contingent, and they’re all very necessary and frustrating. And a fact of life.

It will be a tight race, but we are hopeful we could have a cut-off point on deposits on the 22nd of April, to be able to launch the on May 2nd.

“Worst case”, if one or more of the administrative gatekeepers drag their feet (looking at you Skatteverket, Finansinspektionen, SEB, Morningstar and Euroclear) it will take slightly longer and bleed into next month.

One thing that has struck me as we have met and discussed the fund with several potential investors in recent weeks, is how different investing in a small hedge fund is compared to a fund run by a large institution. Protean Funds is very personal. We’re not an “exposure” or an “allocation”. To us Protean is our sole vehicle for investing and existence as a business entity. Period. It’s not an “institution set up to tick boxes”. It’s structurally designed to optimise for performance, as best we can. Asymmetric bets, carefully chosen to try and thread the needle of returns and capital preservation. There will again be periods where investors focus more on return of your money than on your money. If you want to join, great. If you don’t, that’s fine too. We’re not compromising to please everyone. The structure is set and the die have been cast.

Our strategy, while sensible and thought through (asking me), does not fit into style boxes and themes, or strict ESG-frameworks and track-record measurements. We want investors to self-select rather than be sold to, and that our honest approach (and future returns, touch wood) is enough to entice a large enough crowd joining to generate break-even economics. We’re taking personal economic risks in this venture, and realise prospective investors do too. To those that dare: we salute you!

Don’t hesitate to get in touch if you have questions. We promise to answer them all to our best ability. We allocate some time each week to speak to current and prospective investors. If you would like to have a meeting in Stockholm, let us know and we will find time, or if you’d rather have a call, regardless of size. Our minimum investment is SEK 50,000, as dictated by Finansinspektionen, allowing most retail investors the option to engage (I will sneak it in here that the fund will be launching on Nordnet exclusively). This ties well in with our simplicity approach to have but one share class, with no discounts for bigger investors or founders. We all pay the same fee to try to make Protean Funds a viable business. Or not. It’s entirely up to you. And us, to prove our worth.

Weltschmerz

If you’re anything like me – an amateur tuning fork for world sentiment – you will right now be suffering from an undefined feeling of dissonance and discomfort at the state of being. The closest I can get to find a word for this feeling is Weltschmerz. Literally translated from German as “the pain of the World”. John Steinbeck put it in East of Eden, as:

“…the world’s sadness that rises into the soul like a gas and spreads despair so that you probe for the offending event and can find none.”

Right now, there are so many negatives racking up out there that it’s hard to point at any single culprit causing this particularly acute weltschmerz (which is the actual definition, as the astute reader will notice). A less literary, and more homo economicus, way of measuring the current level of weltschmerz is Consumer Confidence. Mind you, consumer confidence is plummeting. Understandably: negative (real) disposable income growth, energy prices, the war in Ukraine, supply-chain snafus, Global warming, plastics in the ocean, deteriorating fertility, accelerating cancer incidence, Covid-19, economic inequality, erosion of institutional trust, Sweden didn’t make the Football World Cup. The list goes on.

The world moves in cycles. Autumn follows summer. Busts succeeds booms. After sunshine comes rain. Innovation is born from stagnation. In that sense, I believe it’s fair to say we have enjoyed several years, indeed decades, of overall benign macro conditions. Almost all measurements of the human condition that matter have improved markedly: poverty, child mortality, average life span, significantly reduced number of major wars etc etc. Innovations in medicine and technology have driven substantial improvements both in productivity and human welfare. The currently accelerating world angst, I believe, is simply the flip side of the human cycle. Progress is not linear, although Keynesian economics has become the undisputed consensus policy method (and let’s not forget its uppity cousin on speed “Modern Monetary Theory”). Ever accelerating improvements or, in the words of Dire Straits “Money for nothin’ and chicks for free”, is not a given.

We must mentally (and economically) prepare for the eventuality that arrows can also point down, despite Western Governments doing their outmost to put make-up on the pig by patching structural challenges with short term transfers of wealth via the printing press. Making a difference takes sacrifice, but for someone optimising for 4-year election cycles, encouraging even limited personal sacrifice does not seem to be an attractive option. Lowering thermostats in Europe by 1 degree Celsius could, according to The Economist, enable a cut in imports of Russian gas by 10%, as but one example.

Generational theory of everything

Drawing on the (somewhat pseudo-scientific) Strauss-Howe generational theory, we could be entering a “turning”, where a new social, political and economic mood takes hold. Strauss & Howe argue these mood periods, or eras, last for 20-25 years, and are characterized by the basic alternations between Crises and Awakenings. As Wikipedia eloquently puts it: Both of these are defining eras in which people observe that historic events are radically altering their social environment. Crises are periods marked by major secular upheaval when society focuses on reorganizing the outer world of institutions and public behavior. Awakenings are periods marked by cultural or religious renewal when society focuses on changing the inner world of values and private behavior.

To me that sounds very much like what’s going on in my observable universe right now: the woke and cancel culture of late, paired with emergent spiritual fads and self-development that has accelerated in the past few years, were perhaps the crescendo preceding the crisis, ushering in a new era of societal focus on institutions and nation states? Nationalism, de-globalization and a “multi-polar world” comes to mind as typical buzzwords making ground. Do you agree? Have a glance at the book “The Fourth Turning”.

While I have no view on the prediction power or falsifiability of generational theory as a model and guide to the future, it certainly rhymes with how I view the world. It takes roughly a generation to forget the lessons of historical atrocities. It takes less than half a generation of stock market investors to forget the last big bear market. It takes a primus motor to galvanize a movement (be it a Trump or Putin or whatever) and dress the part as historical catalyst. Having mental models to help grapple with world events soothes cognitive dissonance but is in the short-term not very helpful, like trying to understand greater conflicts by solely looking at geography - t’s interesting, but with limited practical value over any short-to-medium-term investing time horizon.

What does Social Science have to do with investing?

Everything. First, investing too is a social science. In a sense “social science” is a contradiction in terms, because you can never exactly replicate an experiment, which also holds true for investing. Some things only work once in a generation. There’s little sign of Scientific Method here. It’s like investing in a bubble – like a religion: if we stop believing, it ceases to exist. If the peer is valued at 10x sales, why wouldn’t this similar business be? But if the peer just de-valued to 2x sales, what’s my company now worth? Ask Kinnevik. There’s little room for scientific method in investing (see LTCM). Things that never happened before happen all the time, bulldozing scientific method to the side of the road.

Second, at (potential) turning points it’s easy to anchor to recent history: if we recently valued a stock at 100, and nothing has changed but psychology, yet the stock trades at 20, why wouldn’t the stock go back to 100 eventually? Here I invoke George Soros theory of reflexivity: how we act impacts the playing field. The stock doesn’t care it’s trading at 20. There’s no Charter of Equity Rights saying it’s entitled to reaching historical highs again. Changing the market psychology changes the entire game. You are not investing in a vacuum. Your actions matter. More so if you realize there are millions of investors who think just like you and me. Who have the same-ish education and cultural experiences. You are never alone. Will the one original investor please stand up?

Third, understanding the environment in which we operate in a qualitative sense rather than quantitatively, largely cancels the faux comfort of being able to derive a company valuation with four decimals. If viewing investing and markets as a complex adaptive system (read Maboussin!) teaches you one thing it’s this: humility. The World doesn’t care what your Excel model says. Having an original thought and putting a position on will do you no good until the world comes around to your view. If you can add the filter of psychology to your toolbox, I believe you made it to the next level (in this highly addictive game of constantly changing rules).

It's harder than ever. Again.

What do you think about the market? Speaking to investors, companies, relatives, and friends it seems there’s a consensus it’s “harder than ever” to figure out what’s going to happen. Give it 12 months and we will all think it was obvious: of course, we were heading for a recession and bear market, I mean just look at the end of QE and rate hikes intersecting with inflation and geopolitical tensions! Or: of course, this was a massive buying opportunity, the central bank put is still in effect and we were just heading out of a global lock-down with pent-up demand triggering transient supply-chain shortages, and we knew all along the Ukrainian situation would fade from public consciousness!

It was hard 6 months ago as well, but looks and feels obvious with perfect hindsight. It will be hard 6 months ahead as well. Look, it’s always hard. Predictions are hard, particularly about the future. And that’s the point: hindsight bias is an effective mental band-aid. My view is it’s allowed to be balanced. One does not have to assume the end of the world is nigh, or that we’re currently in a once-in-a-generation buying opportunity. It’s ok to not have a strong view on the market. There are ample opportunities on the long and short side when looking at company specifics, which combined make up a portfolio that, almost regardless of the general market direction in the short term, can yield attractive positive returns. Perhaps not the most marketable quote out there, or one likely to generate clicks, but an honest and open-minded approach. Right now, it’s what we have to offer.

How we think and why

During March we participated in a “Capital Introduction” event, where fund managers present themselves to a group of institutional investors. The theme of the event was “Best Ideas” and it was therefore a pre-requisite to present an idea, in order to give prospective investors a feel for what the fund manager is looking for. 100% of the other funds that participated presented longs. Which is understandable. Stocks go up over time. It’s more fun to be positive. It’s not controversial. You don’t risk rubbing company managements (and other fund managers) the wrong way by poo-pooing something they care an awful lot about. If you have read earlier editions of the Partner Letter, you know we want to focus on our process and investing, not on broadcasting single stock ideas (regardless of how media friendly). The reason is simply that we want to maintain maximum flexibility. By publicly stating various specific views we are both associated with and tied to the stock in ways we’d rather avoid.

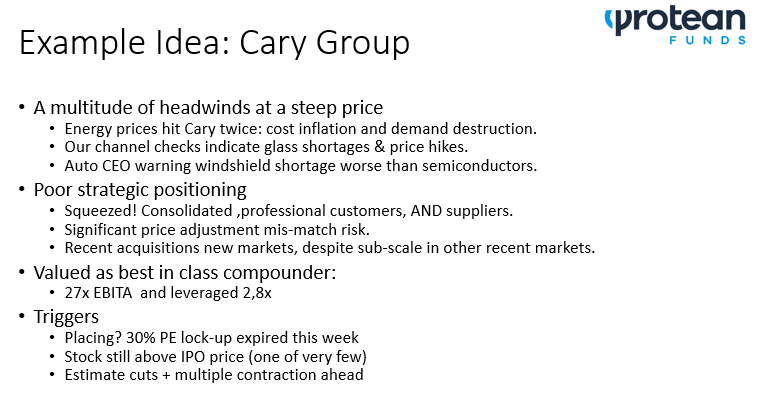

Regardless, we had to present an idea, because as reclusive as we want to be in an ideal state, there is no fund without investors, so we do need to participate in asset-raising games at least initially, to raise a modicum of awareness that we exist as a remote option. We thought long and hard about which stock in our make-believe-portfolio we would consider a reasonable proxy for our process. We concluded the short position in recently IPO’d 1bn USD mcap Cary Group was a good example since we were not overly keen on either the business fundamentals, the strategic positioning, intel from industry participants in various roles, public data points from competitors and customers, the lock-up expiring or the remarks from the CEO at a recent seminar. We also concluded valuation appeared challenging, that sell-side estimates looked on the high side, and that banks and brokers right now have an economic incentive not to turn negative since they’re all hoping to get a lucrative secondary placing of stock through the door (hence zero sell-ratings despite the – to us – obvious negatives). In summary: when we put the hypothetical position on it looked a good risk/reward, and a reasonable example of the type of reasoning and work we aim to do.

Having done the work of putting the example case together on a slide as marketing material to the institutional investors, I thought: why not share also publicly as an example of our process? We have no actual position in the stock, there’s nothing particularly proprietary about our view, and we do aim to raise a retail tranche of assets, which means the public might also benefit from understanding a bit more about our process. So, I shared the slide. Guess what happened?

Here the slide, which is a short summary of the thesis. There’s more to each point, but when you have 15 minutes to present yourselves and your process, followed by an idea, you can’t exactly afford to write an essay.

The stock dropped 10% on the day. The local business press wrote about Protean Funds; a “newly started fund company talked unfavorably about Cary Group” and detailed our argument in the next days’ paper (in a very balanced way to be fair, and I stand by my opinions). A sell-side analyst covering Cary wrote an email to his institutional clients (except Protean, notably) detailing, bullet point by bullet point, all the ways in which we were clearly mistaken (funny that, you don’t see it happening when someone is touting a long?). We received emails and phone calls from various other high-profile stakeholders in this situation, wondering what we were up to, potentially torpedoing all the best laid out plans for the Cary Group equity narrative?

But here is the problem: with the stock down 10%, maybe it just reached our target price? Can we cover the position and move on when we just publicly got associated with a fundamental short? When someone apparently acted on our thesis? Someone, who two weeks later thinks it’s Protean’s fault they’ve lost money as the stock has bounced back? What if it’s a BUY at 65? Is that the game we want to play? Introducing unnecessary variables? No, it’s not. We don’t want to be associated with single stocks. We don’t want the mental baggage. We don’t shy away from admitting to being wrong. Quite the opposite: we are trying to lower the bar to admitting we’re wrong. It’s humility by design.

Our attitude is this: if it’s a marginal benefit to our decision-making process, and ultimately investors, not to be publicly associated with a holding, we’ll choose that benefit every time. That said, I’m sure there will be times when going public will be beneficial for investors in the fund, in which case we will not hesitate to engage. We’ll aim to adapt, if and when. To be protean.

Fingers crossed the admin works out in the coming weeks and we can get started, allowing future partner letters to focus more on the ins and outs of actual investing.

Pontus Dackmo

Investment Manager & CEO

Protean Funds Scandinavia AB